TL;DR

In 2026, Amazon Ads success for UK sellers depends on relevance and outcomes, not higher bids. Rising CPCs, VAT, and tighter margins make aggressive spending unsustainable.

ACoS and ROAS alone no longer reflect profitability. Metrics like TACoS, net sales after VAT, and contribution margin give a clearer picture of whether ads are truly driving growth.

UK buyer behaviour requires intent-based bidding. Lower bids work better during research stages, while higher bids should be reserved for decision-ready searches to improve Amazon PPC sales conversion.

Listing quality directly affects CPC. Strong creatives, clear messaging, and compliant content can lower CPC and improve conversion without increasing bids.

AI-powered Amazon PPC automation helps manage scale and speed, but human control is essential to protect margins, set guardrails, and focus on profitable keywords.

The UK sellers who win in 2026 are those who optimise ads and listings together, align bids with real customer intent, and make disciplined, data-backed decisions instead of chasing volume.

If your Amazon UK ad costs keep rising while sales feel harder to win, you are not imagining it. In 2026, Amazon Ads will no longer be just about getting clicks or staying visible. It is about proving relevance, efficiency, and commercial value at every stage of the buyer journey.

UK sellers are operating in a tougher environment than the US. CPCs are higher, margins are tighter once VAT and FBA fees are applied, and demand growth is slower and more cautious. Simply increasing bids to stay competitive now burns the budget faster than it drives growth.

This is why 2026 demands smarter bidding, not higher spend. Amazon’s systems have shifted toward outcome-led signals, AI-driven optimisation, and relevance-based placement decisions. Ads that convert well, feel helpful, and align with buyer intent are rewarded with better visibility and lower costs.

This blog breaks down why ACoS alone no longer works, which UK-specific metrics should guide bids, how buyer behaviour changes bidding strategy, how creative impacts CPC, and how to use AI tools without losing control of your margins.

How Amazon ads are changing for UK sellers

Amazon Ads leaders are sending a clear message to UK sellers in 2026: bidding is no longer just about how much you are willing to pay. Amazon is steadily shifting from hands-on manual control to AI-assisted optimisation, where the system decides when and where your bids compete.

Sellers who understand this shift are seeing stronger results, while those relying on old bid tweaks are falling behind. What really influences bidding outcomes now is what happens around the bid. Creative quality, listing conversion rates, and clean data all shape how Amazon’s algorithm values your ads.

When your product page is clear, compliant, and built to convert, Amazon rewards that confidence with cheaper clicks and better placements. UK category data shows that ads linked to high-converting listings can win placements with CPCs up to 25% lower than poorly optimised pages, even with similar bids.

Relevance has become the real cost saver. Ads that closely match shopper intent naturally earn higher click-through rates, which lowers CPC without forcing higher bids. This is why bid efficiency is now tightly linked to listing quality and audience understanding. Amazon PPC strategies for UK sellers in 2026 will reward those who optimise ads and listings together, not in isolation.

Why are ROAS and ACoS no longer enough in 2026?

In 2026, UK sellers can no longer optimise bids using ACoS or ROAS in isolation. These metrics look good in your Amazon business, but they hide what actually matters: profitability. UK-specific costs like 20% VAT, higher FBA fees, returns, and currency swings often turn “good” ROAS campaigns into quiet margin leaks, especially in competitive categories with thin margins.

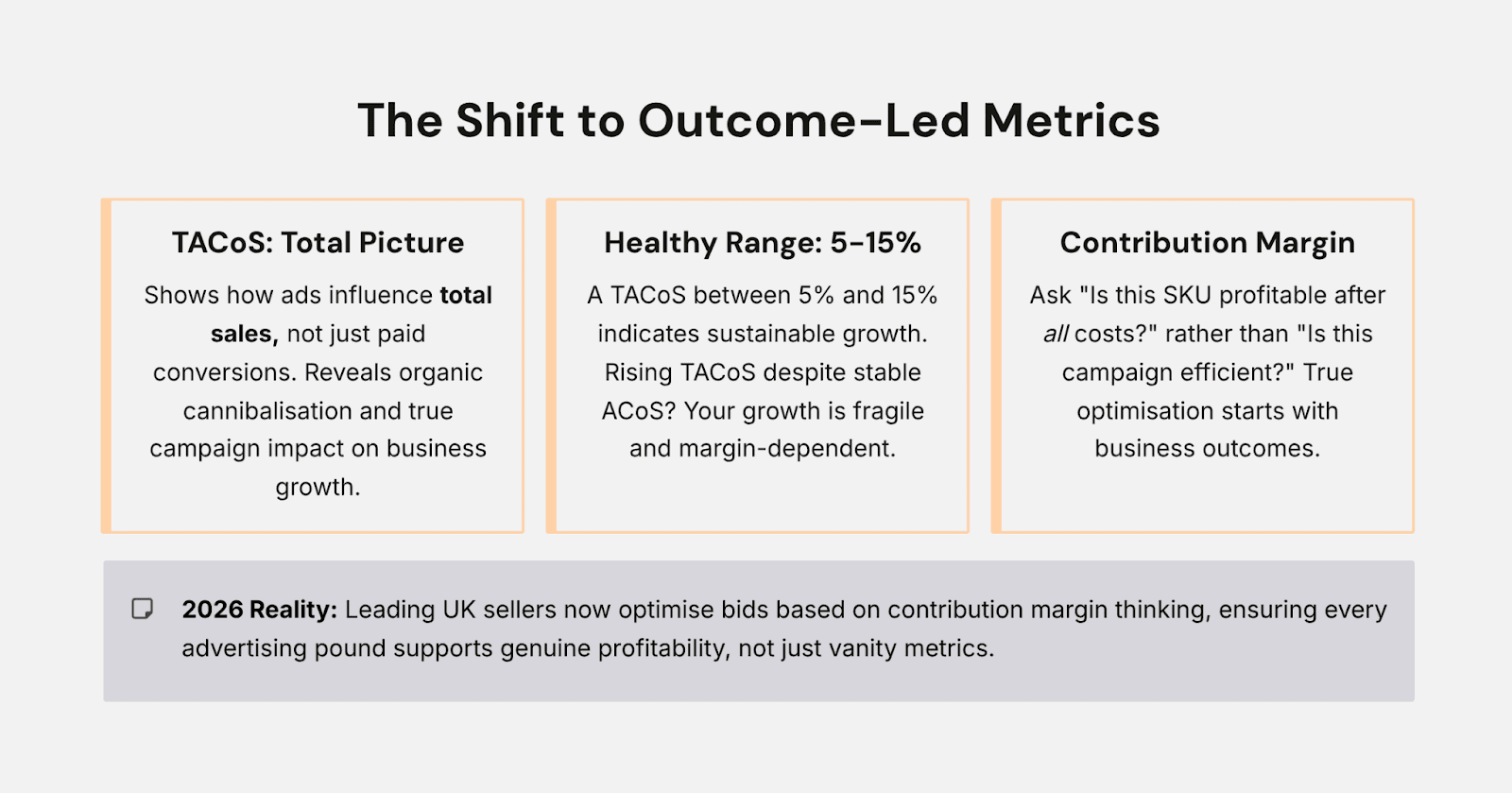

This is where outcome-led metrics matter. ACoS ignores organic cannibalisation, wasted budget, and whether ads are supporting long-term ranking. That is why more UK sellers are shifting to TACoS, which shows how ads influence total sales, not just paid ones.

In 2026, a healthy TACoS typically sits between 5% and 15%. If it keeps rising while ACoS looks fine, your growth is fragile.

Leading sellers are also moving toward contribution margin thinking. Instead of asking, “Is this campaign efficient?”, they ask, “Is this SKU profitable after all costs?” Bid optimisation now starts with business outcomes, not ad metrics alone.

UK-specific outcome metrics that should guide bids

In 2026, smart bid optimisation for UK sellers starts with business outcomes, not ACoS alone. Metrics like ROAS and ACoS still matter, but they only tell part of the story. What really drives sustainable growth is understanding how ads affect total sales, margins, and long-term customer value.

Metric | What it shows | How UK sellers should use it |

TACoS (Total Advertising Cost of Sales) | Whether ads are driving overall growth or replacing organic sales | If ACoS is 18% but TACoS stays around 9% while organic sales grow, ads are improving rankings rather than cannibalising demand. Stable UK brands typically target a TACoS between 5% and 15%. |

Net sales after VAT | Your true revenue after tax and fees | A £25 sale may drop to around £4 after VAT, FBA fees, and returns. Bid decisions should be based on this real margin, not headline revenue. |

New-to-brand and repeat purchases | Long-term customer value, not just first-order profit | A higher CPC that brings 60% new customers or repeat orders can outperform cheaper clicks that never convert again. This allows bidding with clarity instead of guesswork. |

How outcome-led thinking changes PPC optimisation

When you start with business outcomes, the question is no longer “What ACoS can I tolerate?” but “What is this click actually worth to my business?” Outcome-led thinking forces UK sellers to connect bids to real commercial impact, not just ad efficiency.

For example, a keyword with a higher CPC may look expensive on the surface, but if it consistently brings new-to-brand customers and lifts organic ranking, the true return is far stronger than a cheaper keyword that only converts existing buyers. In this case, bidding lower to protect ACoS can actually slow growth.

Outcome-led bidding also changes how you scale. Instead of raising bids across the board, UK sellers increase bids only on terms that improve TACoS, protect net margin after VAT, or drive repeat purchase behaviour. Keywords that drain budget without improving these outcomes are capped or paused, even if their ACoS looks acceptable.

In 2026, winning bids are not the cheapest ones. They are the bids that align with profit, growth, and long-term customer value.

How UK buyer behaviour should shape your bidding strategy

UK buyer behaviour plays a much bigger role in bidding decisions than many sellers realise. Compared to US shoppers, UK buyers tend to research more, compare alternatives carefully, and take longer to convert.

The first click is often part of a journey, not the final decision. If bids are set too aggressively at the top of the funnel, the budget gets burned long before the sale happens. This is why early-stage bidding often wastes spend in the UK.

Broad and exploratory keywords attract curious shoppers who are still comparing prices, reviews, and delivery terms. High bids in this phase can inflate CPCs without improving conversion, especially in competitive categories like home, personal care, and grocery. Lower, controlled bids protect margins while still keeping your product visible during research.

Higher bids make sense when the intent is clear. Keywords that include exact product types, sizes, or use cases signal buyers who are close to purchasing. In these moments, UK shoppers care more about trust, delivery speed, and clarity than price alone. Bidding up on high-intent terms helps you stay visible when the decision is about to be made.

The smartest UK sellers adjust bids by intent stage to improve Amazon PPC sales conversion. Lower bids support consideration and research-focused searches, while higher bids are reserved for decision-ready terms where buyers are closer to purchase.

This approach aligns ad spend with how UK shoppers actually buy, rather than how sellers wish they did, resulting in more efficient budgets and stronger conversion performance over time.

Bid optimisation in a world where creative affects CPC

In 2026, bid optimisation for UK sellers is no longer separated from creative quality. Amazon’s ad system now rewards ads that feel natural and helpful, with internal benchmarks showing listings with strong creative typically see 20–35% higher click-through rates and up to 25% lower CPCs than generic ads.

When an ad blends into the shopping experience and clearly answers a buyer’s question, Amazon sees stronger engagement signals and lowers the cost of traffic. This is where many UK sellers lose money without realising it. Weak main images and generic titles reduce click-through and conversion rates.

Data from category performance reports shows listings with sub-par content often require 10–30% higher bids to maintain visibility compared to optimised listings.

When shoppers hesitate or bounce, Amazon compensates by raising CPC to maintain placement, meaning higher spend without more conversions. Smart sellers now align bid increases with creative upgrades. You can also hire the best Amazon marketing agency to optimise listings, refine ad creatives, and align bidding strategies with real buyer behaviour.

Before increasing bids on a keyword, they improve images with UK-specific cues like delivery expectations and compliance badges. Copy is tightened to answer common comparison questions UK buyers ask, and Amazon A+ Content is used to remove doubt. Listings that implement these changes often see CPC decrease while conversion increases.

The mindset shift is simple but measurable. Creative quality is no longer just about branding. Listings with high-quality content outperform peers on CPC, CTR, and conversion, giving UK sellers a competitive edge that pure bid tweaking can no longer deliver.

Use Amazon PPC automation software without losing control of your bids

In 2026, AI-powered Amazon PPC optimisation software is essential for UK sellers. AI now adjusts bids in real time based on shopper intent, conversion probability, placement performance, and listing quality. This speed is powerful, but it does not understand your business context.

What AI is doing behind the scenes

Adjusting bids dynamically based on predicted conversion likelihood

Prioritising placements that drive volume, not necessarily profit

Reacting instantly to competitor moves and short-term demand shifts

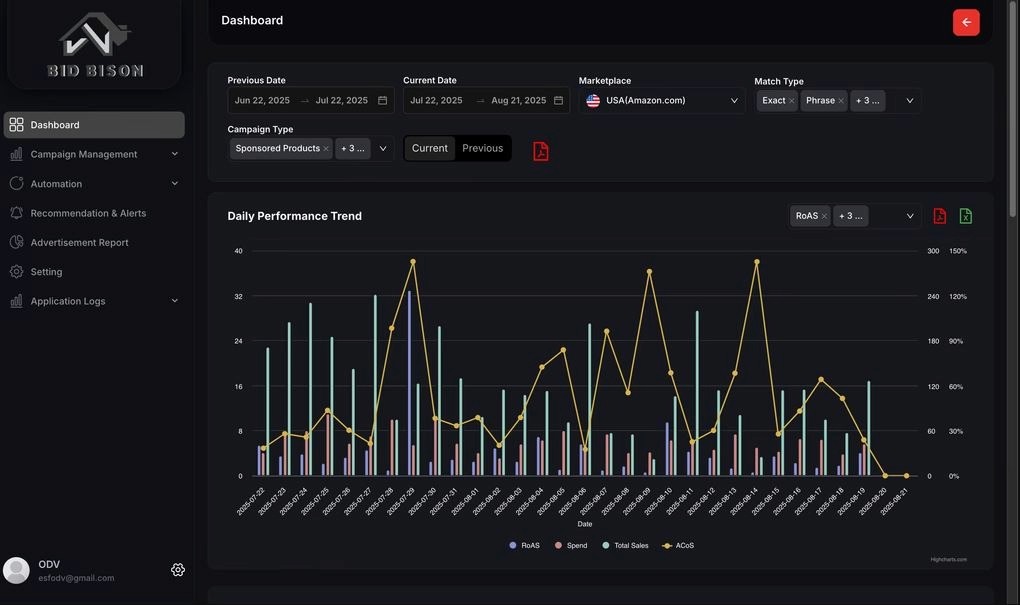

This is where Amazon ads automation tools, like Bidbison, help the UK sellers manage high-volume keywords where manual bidding is slow and inefficient, reacting to seasonality and daily demand fluctuations, and maintaining visibility on proven, stable ASINs.

BidBison strengthened this advantage by automating campaign creation and managing bids in real time on top-performing keywords, saving hours of manual work while keeping campaigns active and competitive. BidBison’s performance tracking and analytics give UK sellers a clear view of what is actually working. Instead of trusting automation blindly, sellers can:

Set bid caps and budget guardrails

Focus spending on keywords that support profit, not just ACoS

Pause campaigns that hurt contribution margins

The smartest UK sellers let AI handle execution, use BidBison for clarity and control, and apply human judgment to protect profitability and long-term growth.

A practical bid optimisation framework for UK sellers

1. Weekly bid review rhythm (avoid volatility)

Review bids once a week, not daily

Look at 7–14 day trends, not single-day spikes

Separate learning keywords from proven performers

Make small, controlled changes, not aggressive jumps

2. What to adjust first (in order)

Fix images, titles, and A+ first; poor creative inflates CPC

Adjust the top-of-search only after conversion improves

Change bids last, once data and intent are clear

3. How to scale winning bids safely

Increase bids in 5–10% steps, not big jumps

Scale only keywords with stable conversion and TACoS

Watch CPC for 3–5 days before increasing again

Pause scaling if CPC rises faster than sales

4. How to protect margins

Lower bids on research-stage keywords

Cap bids during peak UK fee periods

Shift budget toward high-intent, decision-ready terms

5. Building discipline into bid changes

One variable change at a time

Always note why a bid was changed

Roll back changes that hurt margin, even if ACoS looks fine

Let the data settle before acting again

Final thoughts

In 2026, winning Amazon Ads in the UK is no longer about pushing bids harder, it is about being more relevant. UK shoppers compare more, hesitate longer; and reward brands that feel clear, trustworthy, and helpful. Amazon’s AI follows that behaviour.

It lowers costs for sellers who are prepared and quietly punishes those running sloppy ads, weak listings, or disconnected strategies. The future of bidding is not aggression; it is alignment. When bids support strong creative, accurate data, and real customer intent, CPCs become easier to control, and growth becomes more stable. This is why working with an experienced Amazon PPC agency UK now plays a critical role in turning performance data into disciplined, scalable action.

UK sellers who connect bids with customer insight, listing quality, and profitability will scale efficiently in 2026. Those who rely on higher spend alone will simply pay more for the same results.