TL;DR

Amazon UK listings that look “fine” can still underperform in 2026 due to small gaps in clarity, structure, and compliance that quietly reduce conversion and increase ad costs.

Competition across UK categories is higher, buyers decide faster, and Amazon enforces content rules more strictly, making weak listings expensive to maintain.

Manual listing reviews miss hidden issues like unused character space, weak image coverage, and policy-sensitive wording that never triggers Seller Central warnings.

AI-driven listing optimisation helps UK sellers identify exactly what is hurting performance, based on data, not guesswork or generic best practices.

Better listing structure directly improves ad efficiency by lowering CPCs and ACoS, since ads no longer compensate for poor conversion.

Tools like SellerQI help sellers prevent compliance risks, unlock unused listing potential, and fix image and content gaps before sales and rankings decline.

Selling on Amazon UK in 2026 feels familiar on the surface, but underneath, the rules have changed. Listings that once performed well with basic optimisation are now quietly losing ground. Traffic is more expensive, shoppers decide faster, and Amazon’s systems are far less forgiving of unclear or incomplete product pages.

For many UK sellers, the challenge is not effort. It is knowing what to fix and why. A listing can look fine in Seller Central and still underperform because of small gaps in structure, clarity, or compliance that never trigger a warning. Those gaps add up over time and eat into margins.

This is why Amazon listing optimisation has shifted away from generic best practices toward data-backed decisions. AI now helps UK sellers see what is really holding performance back, so improvements are based on impact, not assumptions.

What’s changed for Amazon UK sellers in 2026

1. High competition across UK categories

UK categories like home, personal care, electronics accessories, and grocery have seen a steady rise in active ASINs year over year. Industry estimates show that many UK categories now have 25–40% more competing listings than they did just two years ago.

This means buyers compare faster and scroll less. If your title is unclear, your images do not answer questions, or your bullets waste space, shoppers simply move on. AI-led listing analysis shows exactly where your listing falls behind competitors, based on real, measurable gaps rather than assumptions.

2. Strict content and compliance enforcement

Amazon UK has increased automated checks on restricted words, unverified claims, and policy-sensitive language. Listings are now more likely to be suppressed quietly rather than being warned first. Many UK sellers only realise there is a problem when impressions suddenly drop.

The automated Amazon tool scans content before Amazon does, helping catch these risks early, especially for health-adjacent, cosmetic, or regulated categories common in the UK market.

3. Listings now directly affect ad efficiency and profitability

In 2026, ads do not save weak listings. Amazon’s own data shows that listings with poor conversion signals drive higher CPCs and lower ad placements. If your product page does not convert, you pay more for the same traffic.

Amazon PPC software helps UK sellers connect listing quality with ad performance by showing unused character limits, missing images, and content gaps that quietly push ACoS up. For UK sellers, improving product listings with AI is about staying compliant, converting faster, and protecting margins in a market where every click costs more than it used to.

Factor | 2025 status | What changed in 2026 |

Title length | Maximum 200 characters | No change, still capped at 200 characters |

Prohibited characters | Special symbols were not allowed | Rule continues with stricter automated checks |

Backend keywords | Limited to 249 bytes | Expanded significantly to around 2500 characters |

Compliance documents | Required before listing goes live | Ongoing enforcement with faster checks |

AI influence on ranking | Early signals, limited impact | Stronger focus on listing structure and clarity |

Why most Amazon UK listings underperform quietly

Most underperforming UK listings aren’t obviously broken. On the surface, they appear perfectly fine. That is exactly why sellers miss the problem for months.

#1 Listings look complete but miss key conversion triggers

A typical UK listing has a title, bullets, images, and maybe even A+ Content. On the surface, everything checks out. But conversion triggers are often missing. For example, the title may name the product but not clarify who it is for, the images show the item but not scale or usage, and the bullets list features without answering common UK buyer questions like size, compatibility, or everyday use.

#2 Issues don’t always trigger Seller Central warnings

Amazon does not warn you when your bullets waste space, when your images fail to build trust, or when your backend keywords are poorly structured. Seller Central stays silent because technically the listing is “valid”. The result is fewer impressions, weaker conversion, and higher ad costs, with no clear alert explaining why.

#3 Small gaps compound over time

At this point, we can understand with a practical example. A home storage seller is running ads and getting steady traffic. The listing has only five images, no lifestyle context, and bullets that leave half the character limit unused.

Conversion sits at 6%, which feels acceptable. Over time, competitors add better visuals, clearer usage explanations, and stronger mobile-friendly bullets. The UK seller’s conversion slowly drops to 4.5%. CPC rises. ACoS increases. Sales decline, not overnight, but quietly. Nothing was “wrong” with the listing. It was just never fully working.

For UK sellers in 2026, underperformance is rarely caused by one big mistake. It is the result of small, fixable gaps that quietly drain profitability until you actively look for them.

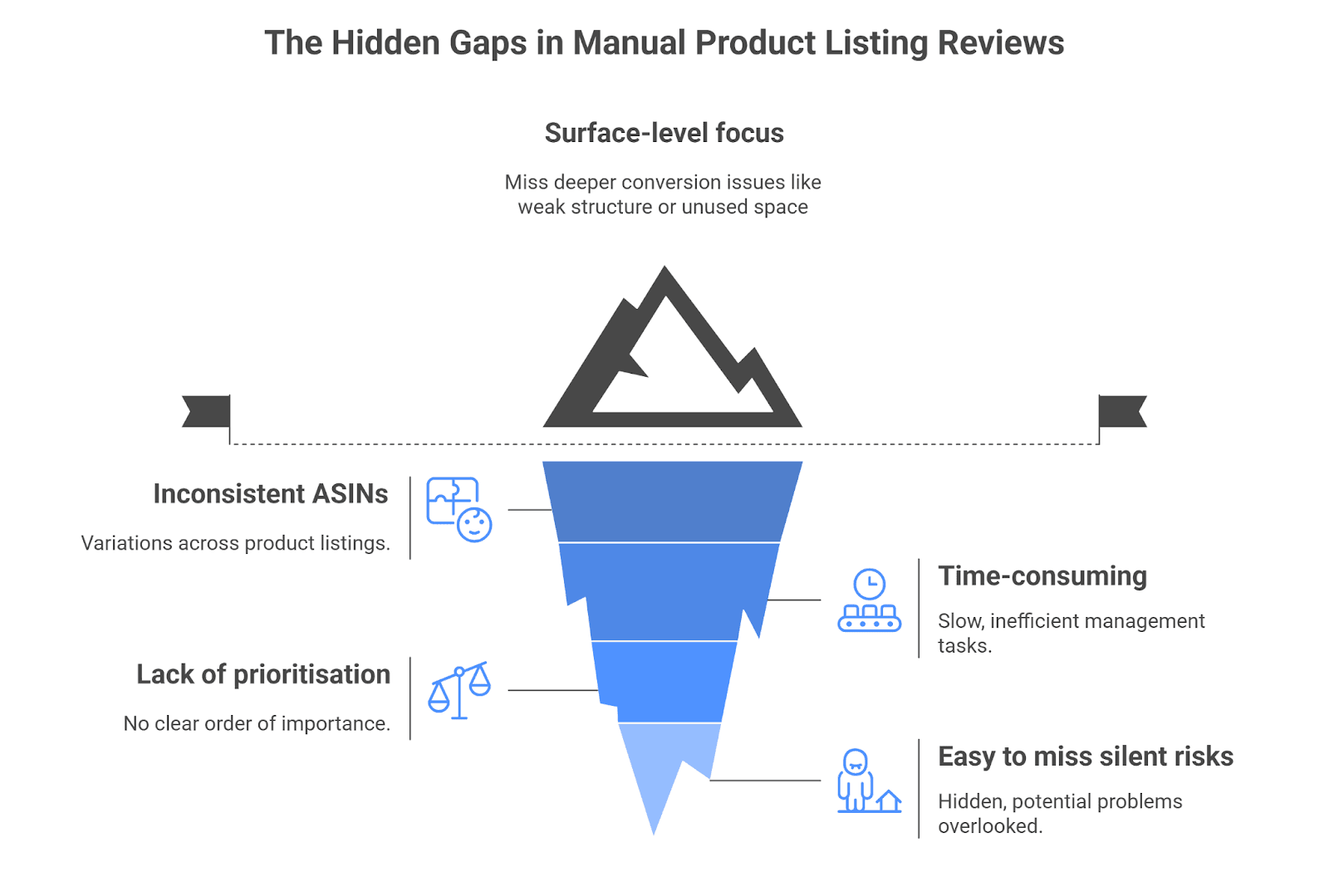

The limitations of manual Product listing reviews

Surface-level focus: Manual reviews usually check titles, bullets, and images at a glance, but miss deeper conversion issues like weak structure or unused space.

Inconsistent across multiple ASINs: What gets reviewed properly on one ASIN gets rushed or skipped on others, especially in larger UK catalogues.

Time-consuming and slow: Reviewing listings properly takes hours, which means updates happen too late to protect rankings or ad efficiency.

No clear prioritisation: Decisions are based on what “feels” important, not on what will actually move conversion or reduce CPC.

Easy to miss silent risks: Restricted words, policy-sensitive phrases, and compliance gaps often go unnoticed until impressions drop.

This is why many UK sellers feel busy optimising listings but still do not see measurable improvements.

How automation software enhances listing optimisation in 2026

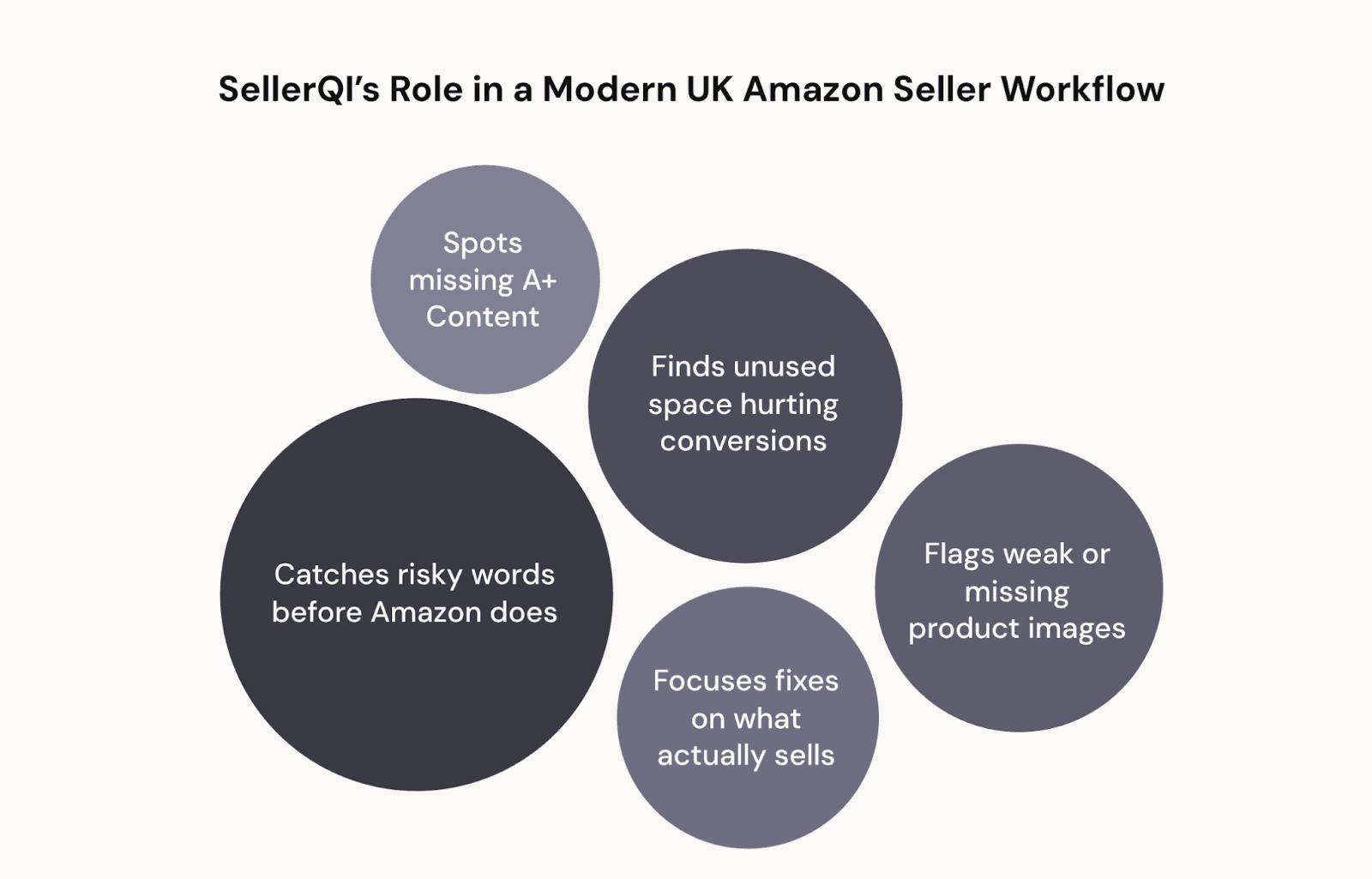

AI software looks at Amazon listings very differently from manual reviews. Instead of applying generic best practices, it works at an ASIN level, analysing each product in the context of its category, competitors, and shopper behaviour.

This matters for UK sellers because what works for a kitchen product may not work for a beauty product. An Amazon product analysis tool does not just check if your listing is “complete”. It measures risk, waste, and missed opportunity.

For example, it can identify unused character space in titles and bullets, flag images that do not support conversion, and spot compliance-sensitive wording before it affects visibility. These are issues that rarely trigger Seller Central warnings but quietly reduce performance.

In 2026, data shows that listings with clearer structure and stronger conversion signals consistently achieve lower CPCs and higher conversion rates. AI highlights exactly which fixes will have the biggest impact, so UK sellers stop guessing and start improving what actually moves rankings, ads, and profitability.

For most UK sellers, the problem is not effort; it is visibility. You can sense that something is off in your listing, but you cannot see exactly where the drop is happening or which change will actually move the needle. That gap between knowing and fixing is where performance quietly leaks.

That is where the shift from manual judgement to data-led clarity happens. Instead of making changes based on instinct or copying competitors, sellers can finally see which parts of the listing are working and improve the organic ranking on Amazon UK.

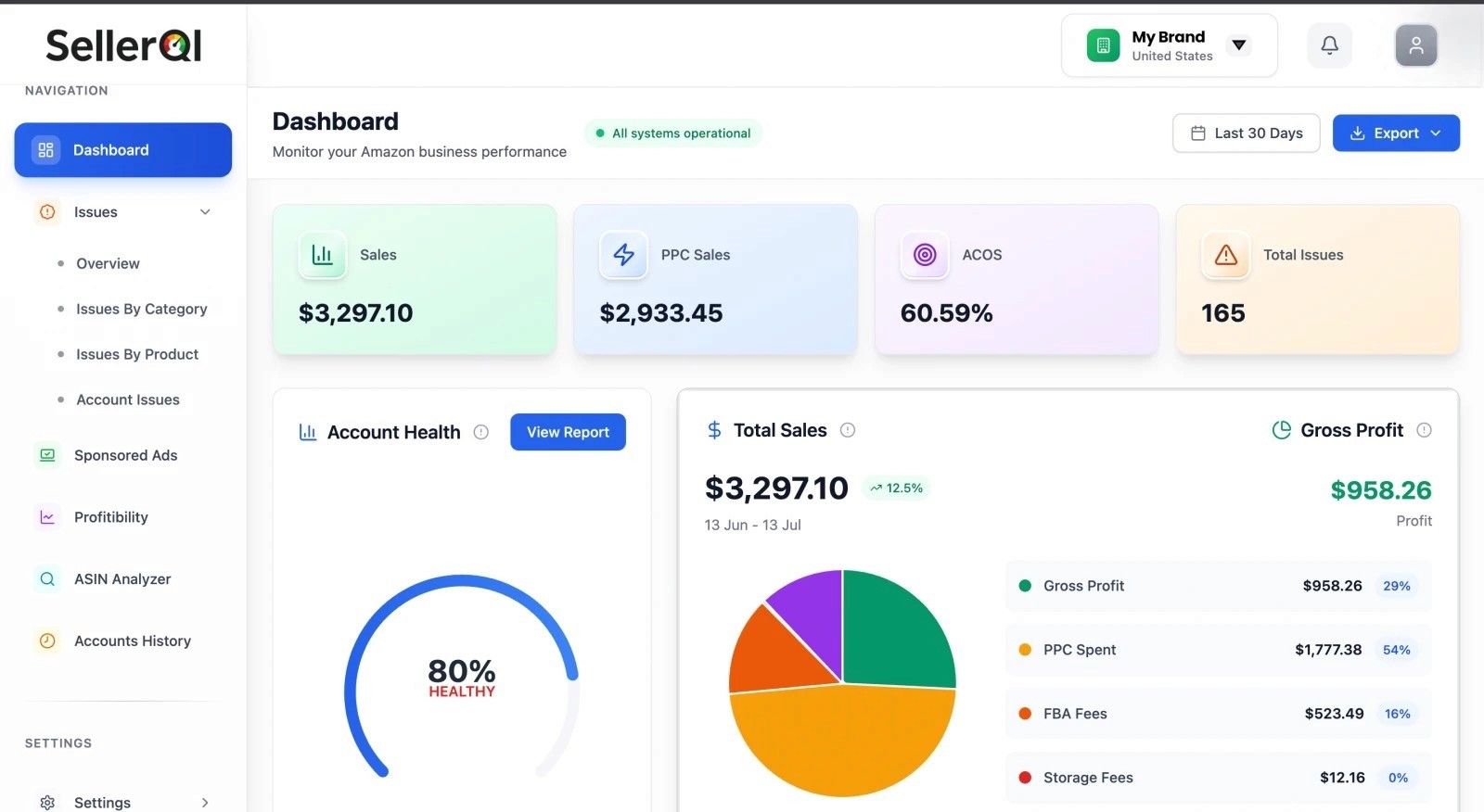

SellerQI takes the guesswork out of fixing Amazon listings. It looks at every detail, from missing images to weak copy and hidden listing issues, and shows exactly what’s holding performance back. Instead of trial and error, sellers get clear, actionable insights that tell them what to fix, why it matters, and how to turn weak listings into strong performers.

How SellerQI brings clarity to listing optimisation in 2026

1. Prevent compliance issues before they cost sales

For many Amazon UK sellers, compliance issues do not show up as clear warnings. A listing can look perfectly fine in Seller Central, yet impressions suddenly drop or ads stop delivering. In most cases, the trigger is a single word or phrase that Amazon’s automated systems flag as restricted or sensitive.

How to fix:

SellerQI helps prevent this by actively scanning listing content across titles, bullets, descriptions, and backend fields. It identifies words and phrases that commonly trigger policy checks and highlights them before Amazon takes action. Instead of waiting for suppression, sellers can make safe edits while the listing is still live and selling.

This early detection reduces the risk of sudden listing interruptions, suppressed ASINs, and lost ranking history. In the UK market, where recovery can take weeks due to compliance reviews and appeal cycles, that downtime quickly turns into lost revenue and higher ad costs.

SellerQI also helps sellers understand why a word is risky, not just that it is flagged. That clarity makes compliance easier to maintain as listings are updated or expanded. In 2026, prevention through visibility is far more effective than reacting after sales and traffic have already been disrupted.

2. Identify unused listing potential that sellers overlook

Most Amazon UK sellers focus on getting more traffic, but overlook how much potential already exists inside their current listings. Very often, the problem is not visibility; it is unused space.

How to fix:

SellerQI highlights where character limits in titles, bullets, and descriptions are not fully used. That unused space is not just empty text; it is free real estate to answer buyer questions, remove doubt, and improve clarity. When UK shoppers hesitate, they rarely scroll further or click again. They simply leave.

This is not about stuffing more keywords. UK buyers respond better to clear explanations, practical details, and reassurance that the product fits their needs. SellerQI helps sellers see where important information is missing or unclear, even when the listing technically looks complete.

By fixing these gaps, sellers make better use of the traffic they are already paying for through ads or organic ranking. Instead of chasing more clicks, the focus shifts to converting the clicks they already have. In a market where CPCs keep rising, turning existing traffic into sales is one of the fastest wins available to UK sellers in 2026.

3. Understand how images influence buying behaviour

UK shoppers are visual decision-makers. Before reading bullets or descriptions, most buyers swipe through images to decide if a product is worth their time. If the images do not answer basic questions like size, usage, or quality, trust decreases instantly, and the listing is skipped.

Insufficient or unbalanced image sets are a common issue in the UK marketplace. Many listings rely heavily on a clean hero image but fail to show the product in real use, scale, or context. When shoppers cannot clearly see what they are buying, hesitation creeps in. That hesitation shows up as lower conversion, even when traffic is strong.

How to fix:

SellerQI helps by flagging listings with too few images or weak image coverage. It shows where important visual gaps exist, not just that images are missing. It also spots A+ Content opportunities that many sellers overlook. Competing without Amazon A+ Content in 2026 is like explaining a product without being able to show it properly.

By using Amazon product listing software, UK sellers avoid guessing. They update visuals when it actually matters, improving trust, clarity, and conversion without unnecessary redesigns.

How SellerQI fits into a modern UK seller's workflow

Final insights

In 2026, Amazon UK sellers are no longer guessing their way to growth. The ones winning are those who know exactly what is holding their listings back and fix it before it impacts sales. Instead of making random changes, they rely on clear data and smart AI signals to guide every decision.

This is where working with an Amazon optimisation specialist really matters. Issues like weak images, missing A+ Content, or hidden content gaps are caught early, not after performance drops. Sellers spend less time reacting and more time improving what actually moves the needle.

For UK sellers facing rising competition and higher customer expectations, listings are no longer just pages. They are assets that need regular attention. With the right insights in place, stable listings turn into scalable ones, built to convert better, rank stronger, and grow with confidence.