TL;DR

- Failing to comply with UK VAT laws can lead to penalties, reduced payouts, and account issues—always price with VAT included and use Amazon’s VAT Calculation Service.

- Using generic or US-style listings hurts your UK visibility—localise spelling, measurements, tone, and keywords for better conversion and search performance.

- Mismanaging FBA vs. FBM impacts your profitability—assess costs carefully and consider a hybrid strategy to balance margin and delivery expectations.

- Running ads without UK-specific strategies wastes budget—track TACoS, use local keywords, and focus on margin, not just clicks.

- Neglecting reviews and customer service damages trust and Buy Box eligibility—engage customers, respond professionally, and monitor seller metrics.

- The UK Amazon market rewards sellers who localise, stay compliant, and build customer-first strategies—getting these fundamentals right sets the foundation for sustainable growth.

Selling on Amazon UK sounds simple—list your products, run a few ads, and watch the sales roll in, right?

But in reality, many sellers make small mistakes that cost them big in visibility, profit, and even account health. Whether you’re just getting started or already generating decent sales, the UK marketplace has its own rules, risks, and opportunities. What works in the US or EU might not translate directly to the UK. From pricing with VAT included to understanding how Brits shop, sellers often overlook the fine details and that’s where things go wrong.

In this blog, we’ll cover the top 5 Amazon seller mistakes UK sellers commonly make—and how to avoid them. You’ll learn how to stay compliant, create local-friendly listings, choose the right fulfilment model, run smarter ads, and build trust through reviews and customer service. If you’re looking to grow sustainably on Amazon.co.uk, avoiding these pitfalls is the place to start.

Top 5 mistakes Amazon UK sellers make and how to avoid them

This section highlights the top 5 mistakes Amazon UK sellers make and how to avoid them—many of which stem from common Amazon problems UK sellers face, such as pricing errors, VAT issues, poor fulfilment choices, and listing compliance.

Mistake #1: Ignoring VAT and tax compliance

For Amazon UK sellers, one of the most common and costly mistakes is ignoring VAT and tax compliance. It may seem like a boring back-office task, but if you get it wrong, the consequences can be serious—penalties, account suspension, and even banned listings.

In the UK, VAT (Value Added Tax) is a consumption tax applied to most goods and services. If your business is VAT-registered—which you must be if your taxable turnover exceeds £90,000 (as of 2024)—you’re required to charge VAT on your sales, submit regular VAT returns, and keep detailed records.

On Amazon, your product listings must show VAT-inclusive pricing if you’re registered. Many sellers miss this or set their prices without accounting for the 20% VAT, which eats into profit or leads to Amazon UK compliance issues.

Amazon.co.uk is strict about this. If you’re VAT-registered, you must upload your VAT number to Seller Central and enroll in the VAT Calculation Service (VCS). This helps display accurate pricing and invoices to customers.

If you don’t, Amazon may automatically withhold VAT from your payouts, reducing your earnings unexpectedly. Sellers also tend to forget that VAT is not just about the UK. If you store goods in other countries (like using Amazon’s European Fulfilment Network or third-party warehouses), you may be required to register for VAT in those countries as well—even post-Brexit.

Another oversight? Not staying up to date with tax thresholds, filing dates, or changes in VAT laws. These rules can change yearly, and Amazon doesn’t always notify you. It’s up to you to keep up—or risk fines and lost time dealing with HMRC (His Majesty’s Revenue and Customs).

How to avoid this mistake:

- Register for VAT early if your revenue is approaching the threshold.

- Use Amazon’s VAT calculation service for compliant invoicing.

- Price your products VAT-inclusive to avoid margin loss and account warnings.

- Hire a VAT accountant or use a VAT compliance service (like SimplyVAT or Avalara) to stay on track.

- Monitor all cross-border storage and sales activity to stay compliant outside the UK.

Tax may not be exciting, but it’s a must. Fixing VAT mistakes is harder (and more expensive) than doing it right from the start. For Amazon UK sellers, getting tax compliance sorted is not just good practice—it’s survival.

Mistake #2: Using generic, non-localized listings

One of the most common mistakes Amazon UK sellers make is using generic, non-localized listings—often copied from US marketplaces or product suppliers. On the surface, this might seem efficient, but in reality, it can cost you clicks, conversions, and ultimately, sales.

UK buyers shop differently from US customers. They expect listings to feel familiar, culturally relevant, and easy to understand. A listing that uses American spelling, phrases, or measurements can confuse shoppers or even turn them away.

For example, a title that says “color” instead of “colour” or “pants” instead of “trousers” may not just feel off—it may not appear in relevant UK search results at all.

Another key issue is tone. UK consumers tend to value clarity, accuracy, and subtlety over hype. Over-the-top claims like “BEST PRODUCT EVER!” may seem trustworthy in US listings, but they often feel exaggerated to UK shoppers. Instead, UK buyers appreciate honest, well-written copy that clearly explains the benefits and uses of the product.

Localization also applies to measurements and product details. UK shoppers expect metric units (grams, litres, centimetres) rather than ounces and inches. A failure to localize this information not only affects trust but can also lead to negative reviews if buyers feel misled.

Amazon’s algorithm also responds better to region-specific keywords. For instance, if you’re selling “trainers,” don’t use “sneakers”—even if that’s what your supplier used. Using local language helps your product show up in the right searches and improves your organic ranking.

How to avoid this mistake:

- Localize all content – Titles, bullet points, descriptions, and backend keywords should reflect UK spelling, terminology, and tone.

- Use UK-specific search terms – Do Amazon keyword research using Amazon.co.uk tools or tools like Helium 10 set to the UK marketplace.

- Convert units and sizes – Always use metric measurements and clearly show compatibility with UK usage (e.g., plug types, shoe sizes).

- Check for cultural alignment – Avoid references that won’t make sense to a UK buyer, such as US holidays or slang.

- Edit for clarity and tone – UK shoppers prefer clear, benefit-led language with a trustworthy tone.

Selling on Amazon UK means writing for a UK audience. A localized listing isn’t just a translation—it’s an optimization. And when done right, it can make a huge difference in how your product performs.

Mistake #3: Mismanaging FBA vs. FBM

One of the biggest mistakes Amazon UK sellers make is not fully understanding the difference between Fulfilment by Amazon (FBA) and Fulfilled by Merchant (FBM)—or worse, choosing the wrong model without thinking through the consequences.

Post-Brexit, this decision has become even more important as fulfilment complexity and costs have increased across borders. FBA means Amazon handles storage, packing, shipping, and even customer service. It’s convenient, helps your products qualify for Prime, and often improves your chances of winning the Buy Box.

But it’s not always the most cost-effective option—especially for heavy, oversized, or slow-moving products. With rising FBA fees and stricter restock limits, blindly sending all your inventory to FBA can quickly hurt your margins.

FBM, on the other hand, gives you control. You manage your own storage and shipping, which can lower costs and give you flexibility. FBM is often better for handmade items, low-volume SKUs, or items with special packaging needs.

However, it comes with risks—slow delivery or poor customer service can hurt your account health, and FBM listings may struggle to compete with Prime-eligible FBA products. In the UK, where VAT-inclusive pricing, higher shipping expectations, and post-Brexit logistics have changed the game, choosing the right fulfilment method is not just about convenience—it’s about protecting your bottom line.

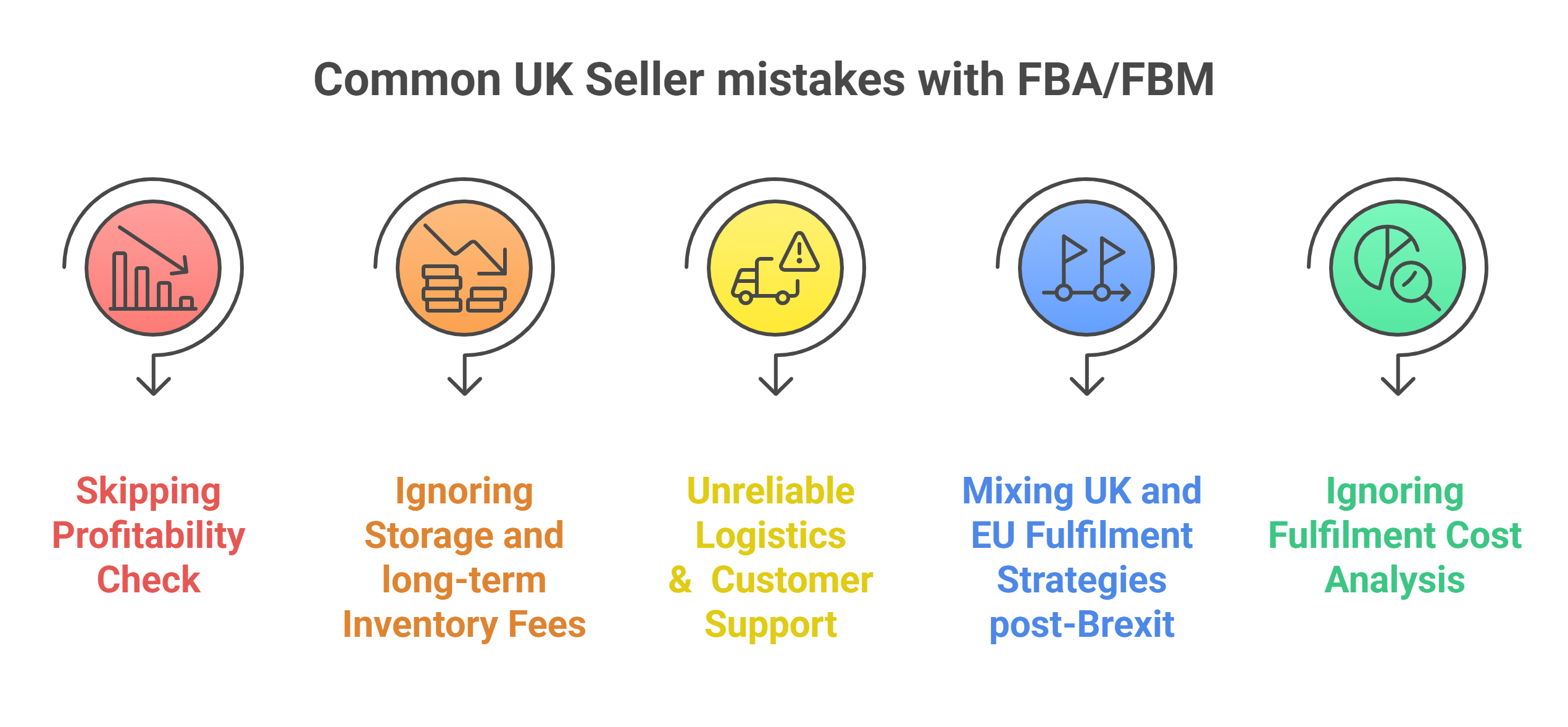

After identifying the common mistakes UK sellers make with FBA and FBM, the next sections explain clearly how you can avoid them.

How to avoid it

- Calculate the numbers: Before choosing FBA, calculate your total costs—Amazon fees, VAT, storage, shipping, and returns. Use Amazon’s FBA revenue calculator (UK) to get a real breakdown.

- Split your catalogue. Use FBA for fast-moving, Prime-sensitive items. Use FBM for heavier or niche products where flexibility matters more than speed.

- Test a hybrid approach. Many successful UK sellers use both methods depending on the product type, season, and demand.

- Revisit strategy regularly. Amazon fees change, customer expectations shift, and your product mix evolves. Don’t “set and forget” your fulfilment plan.

Getting your fulfilment strategy right can significantly impact your sales, profit, and customer satisfaction. Make sure you’re not mismanaging FBA and FBM—it could be the difference between thriving and just surviving on Amazon UK.

Mistake #4: Poor PPC and advertising strategy

One of the biggest mistakes Amazon UK sellers make is running ads without a clear plan—or worse, blindly copying strategies from the US or EU markets. The UK is a smaller, more competitive landscape with unique buyer behaviour, VAT pricing rules, and tighter profit margins. So when sellers rely on guesswork or set-it-and-forget-it ads, they end up wasting spend and missing opportunities.

- Focusing only on ACoS

Many UK sellers obsess over lowering ACoS (Advertising Cost of Sales), but forget to look at the full picture. Low ACoS doesn’t always mean profitability. You need to track TACoS (Total Advertising Cost of Sales), ROAS (Return on Ad Spend), and profit per ASIN to know whether your ads are actually helping or hurting your margins. Don’t ignore VAT, FBA fees, and shipping—those costs hit harder in the UK.

- Using the wrong keywords

Keywords like “pants” may work in the US, but in the UK, customers are searching for “trousers.” UK English matters. Sellers who fail to localise their keyword strategy often miss high-intent traffic. Using UK-specific terms, slang, and even seasonal event keywords (like “bank holiday deals”) can make your campaigns more relevant and profitable.

- Over-relying on broad match and auto campaigns

Auto campaigns and broad match targeting can quickly burn your budget in the UK if not monitored closely. Many sellers fail to check their search term reports regularly, which means they end up paying for irrelevant clicks. Instead, refine your campaigns using exact match keywords, negative keywords, and clear bidding rules.

- Not leveraging FBA or Prime

In the UK, Prime eligibility is a major trust signal. Ads for products fulfilled by Amazon (FBA) often get better click-through and conversion rates, even if the price is slightly higher. If you’re running ads with FBM listings only, you’re likely missing out on Buy Box wins and Prime filters.

How to avoid it

- Build a PPC strategy that’s tailored for the UK.

- Track profitability, localise your keywords, use Amazon reports wisely, and don’t just chase clicks—chase margin-friendly growth.

- With smarter campaign structure and a local-first mindset, your ads can go from costly to consistent revenue drivers.

Mistake #5: Neglecting customer reviews and service

One of the biggest (and most overlooked) mistakes Amazon UK sellers make is treating customer service and reviews as an afterthought. In reality, they’re central to your success—affecting your product visibility, conversion rate, and even Buy Box eligibility.

Let’s start with reviews. On Amazon.co.uk, buyers rely heavily on product reviews before making a purchase decision. According to Amazon UK insights, products with 4+ star ratings and a healthy number of reviews are significantly more likely to convert.

If you’re not actively encouraging feedback or responding to reviews—positive or negative—you’re missing out on trust, credibility, and sales. Some sellers assume that reviews will “just happen.” But unless you’re selling hundreds of units per day, they won’t. The UK audience tends to be cautious and values transparency. You need to nudge the process along—ethically and within Amazon’s terms.

How to avoid it

- Use Amazon’s Request a Review button in Seller Central for every completed order. It’s safe, compliant, and effective.

- Include thoughtful product inserts asking buyers to leave feedback if they’re happy with their purchase.

- Use automated email follow-ups to thank customers and gently encourage reviews—just avoid offering incentives, as that violates Amazon’s policy.

- Respond to every critical review with professionalism. Show future buyers that you care about quality and take action to improve.

Another important factor is customer service—another weak spot for many sellers. In the UK, where customer expectations are high, slow or unhelpful responses can lead to negative reviews, returns, or worse—suspension due to high Order Defect Rate (ODR).

If you’re using FBM (Fulfilled by Merchant), your responsiveness is even more important. Amazon expects you to reply to customer queries within 24 hours (including weekends). Delays can hurt your account health and ranking.

How to avoid it

- Set up automated responses to acknowledge inquiries outside working hours.

- Monitor your Buyer-Seller messaging dashboard daily.

- Track your customer service performance in Seller Central and fix problem areas before they escalate.

Neglecting customer reviews and poor service can lead to serious consequences—including Amazon account suspension in the UK—as Amazon closely monitors seller performance and customer satisfaction. Thus, ignoring reviews and poor service isn’t just a bad habit—it’s a growth blocker. Amazon UK is a customer-first platform. If you take reviews and service seriously, the algorithm—and your buyers will reward you.

Final words

Selling on Amazon UK isn’t just about listing products and running ads—it’s about understanding the fine print, the local mindset, and the systems that drive success. As we’ve seen, the most common mistakes—whether it’s ignoring VAT, skipping localisation, mismanaging fulfilment, wasting ad spend, or neglecting customer reviews—aren’t just minor errors.

The UK market is unique. What works on Amazon.com or in Europe doesn’t always translate. If you’re serious about scaling on Amazon.co.uk, you need a strategy tailored to the local landscape—with smart pricing, relevant content, and a customer-first approach at every stage.

Avoiding these five mistakes isn’t just damage control—it’s a growth strategy. If you’re unsure how to apply this to your brand or need help fixing what’s not working, our e-commerce consultants are here to help. From fulfilment audits to VAT compliance, PPC optimisation to review-building strategies, we provide tailored support for selling successfully on Amazon UK and building a sustainable business.